Market sentiment reflects the aggregated attitudes and emotional responses of investors and traders toward financial markets and specific assets. What is market sentiment? It represents the collective psychology driving market behavior, price movements, and trading volumes across financial instruments.

Core Components of Market Sentiment

Market sentiment manifests through several interconnected components that shape financial market dynamics:

Behavioral Indicators Professional traders analyze crowd psychology through multiple behavioral signals. These include trading volumes, price momentum, and order flow patterns. High trading volumes often indicate strong conviction, while declining volumes might signal wavering confidence.

Technical Analysis Integration Market sentiment interacts with technical analysis through specific indicators:

- The VIX (Volatility Index) measures expected market volatility

- The Arms Index tracks trading volume relationships

- The Put-Call Ratio indicates options market positioning

Social and Media Analysis Financial markets respond to news coverage, social media discussions, and expert commentary. Professional analysts monitor:

- News sentiment through natural language processing

- Social media mention frequency and tone

- Expert commentary trends across financial platforms

Measurement Techniques

Professional traders employ sophisticated methods to quantify market sentiment:

Quantitative Indicators

- Bull/Bear Ratios track institutional investor positioning

- Short Interest Ratios measure bearish sentiment

- Fund Flow Analysis reveals institutional capital movement

Statistical Analysis Market sentiment measurement incorporates advanced statistical tools:

- Time series analysis of price movements

- Correlation studies between sentiment indicators

- Regression analysis of sentiment impact on returns

Machine Learning Applications Modern sentiment analysis leverages artificial intelligence:

- Natural Language Processing (NLP) for news analysis

- Pattern recognition in trading behavior

- Predictive modeling using sentiment data

Practical Application

Professional investors implement market sentiment analysis through structured approaches:

Risk Assessment Framework

- Position sizing based on sentiment extremes

- Stop-loss placement considering sentiment shifts

- Portfolio hedging during sentiment transitions

Trading Strategy Integration Market sentiment informs trading decisions through:

- Entry timing based on sentiment indicators

- Position management using sentiment shifts

- Exit strategies incorporating sentiment analysis

Portfolio Management Professional managers use sentiment analysis for:

- Asset allocation adjustments

- Sector rotation decisions

- Risk exposure management

Contrarian Opportunities Extreme sentiment readings often signal potential market reversals:

- Oversold conditions during peak pessimism

- Overbought situations amid excessive optimism

- Sentiment divergences from price action

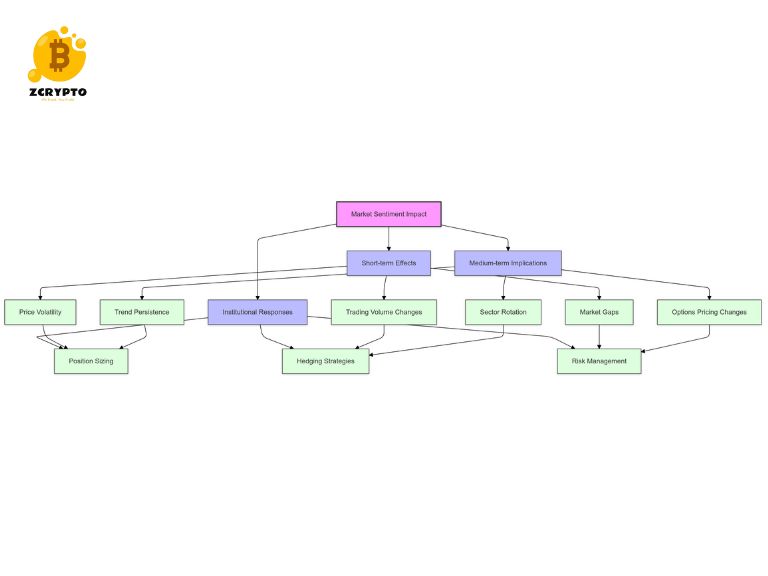

Market Sentiment Impact Analysis

Short-term Effects

- Price volatility increases during sentiment shifts

- Trading volumes reflect sentiment intensity

- Market gaps occur with sudden sentiment changes

Medium-term Implications

- Trend persistence relates to sentiment strength

- Sector rotation follows sentiment shifts

- Options pricing reflects sentiment expectations

Institutional Responses Professional institutions adapt to sentiment changes through:

- Position size adjustments

- Hedging strategy modifications

- Risk exposure management

Professional Integration Methods

Data Analysis Professional traders integrate sentiment data through:

- Real-time sentiment monitoring

- Historical pattern analysis

- Correlation studies with price action

Risk Management Sentiment analysis enhances risk control via:

- Position sizing optimization

- Stop-loss placement

- Hedge ratio adjustments

Strategy Development Trading strategies incorporate sentiment through:

- Entry/exit timing refinement

- Position management rules

- Portfolio rebalancing triggers

What is market sentiment? This critical market force integrates psychological, technical, and fundamental factors affecting financial markets. Professional traders who master sentiment analysis gain valuable insights for strategic decision-making and risk management. Success in financial markets requires careful attention to sentiment indicators while maintaining disciplined trading practices and comprehensive risk management protocols.